DRESDEN, Aug. 14, 2024 — The state Department of Environmental Conservation has notified Greenidge Generation that it will be “unlawful to operate” its Dresden power plant after Sept. 9 and that the company should prepare to close its facility.

That’s the day the company’s Title V air emission permit finally expires, and the last day it has to ask a state court for an injunction to block enforcement.

Greenidge officials did not respond to an email requesting comment on whether they plan court action.

The company, which operates a Bitcoin mining facility at the Dresden plant, has suffered a series of setbacks in recent weeks, and its common stock dipped to an all-time low of $1.75 in trading this morning. For example:

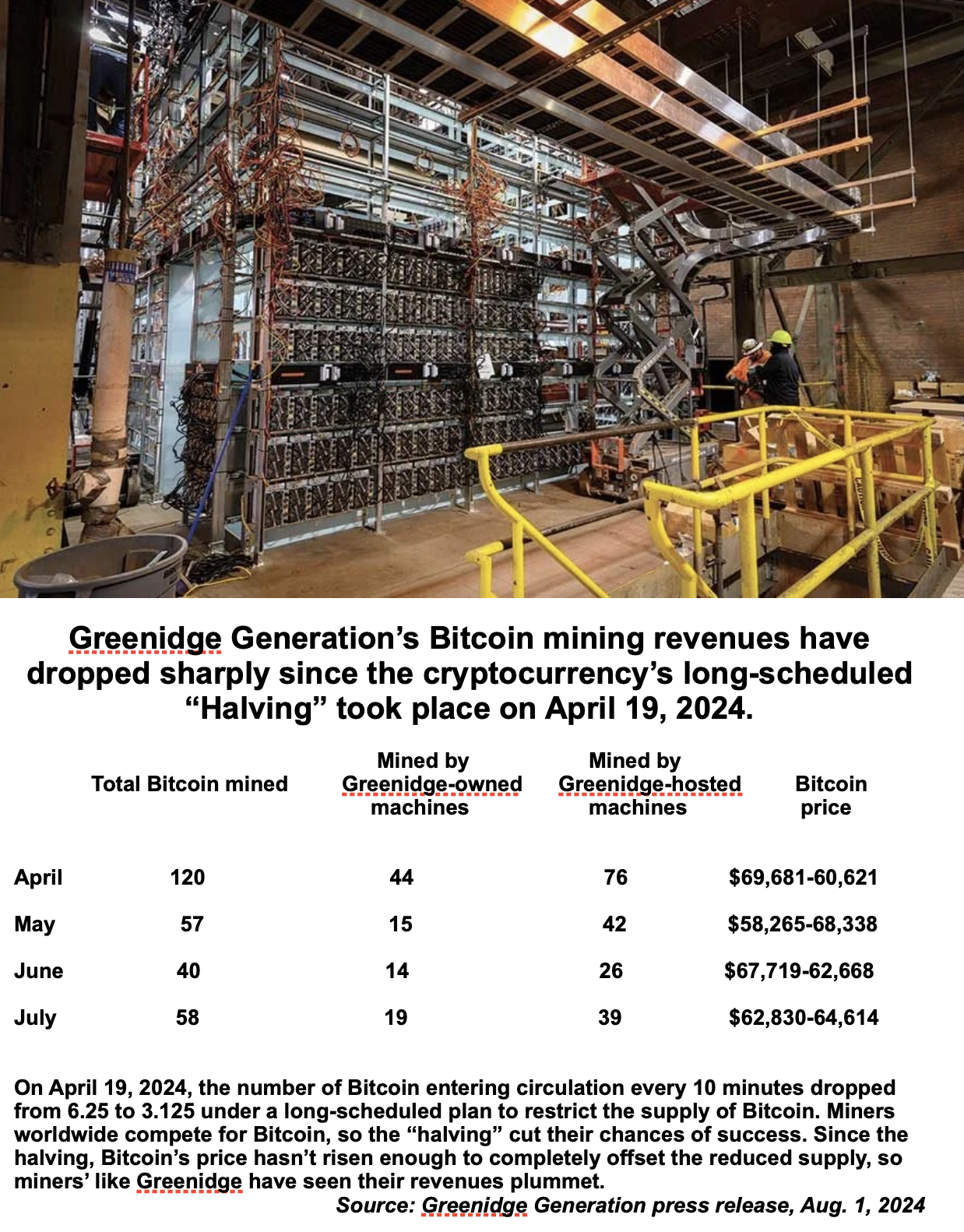

— Greenidge’s mining revenues have plunged in the wake of Bitcoin’s long-scheduled “halving” on April 19. The company said it mined 120 Bitcoin in April, but only 57 in May, 40 in June and 58 in July.

The cryptocurrency’s price has not risen sufficiently since April to offset the reduced availability of new Bitcoin to be mined. In fact, Bitcoin traded at $59,039 this morning, down from its April 19 close of $64,030.

— Strapped for cash, Greenidge announced Aug. 1, a $20 million stock purchase agreement with an affiliate of B. Riley Financial that allows Greenidge to issue new common shares to be sold to B. Riley.

The deal dilutes the earning potential of existing shareholders, who responded by driving the stock down by 35 percent so far this month.

— On Monday, shares of B.Riley suffered a one-day decline of 52 percent after the company’s chairman, Bryant Riley, told investors on a conference call that he had received subpoenas in an investigation by the U.S. Securities and Exchange Commission.

There is no indication the SEC probe has any connection to Greenidge.

But Greenidge and B. Riley have had a close working relationship since Greenidge became a public company through a reverse merger with support.com in September 2021.

Greenidge has relied on affiliates of B. Riley for financing several major stock, bond and loan deals.

In March 2022, B. Riley loaned Greenidge $26.5 million secured by its Bitcoin operation in South Carolina. That was the “third debt financing arranged by affiliates of B. Riley for Greenidge,” a company press release said.

Meanwhile, a B. Riley analyst who recommends stocks for retail investors, has maintained a “buy” recommendation on Greenidge’s stock through the stock’s steep descent over the past three years.

Each $1,000 invested in Greenidge common shares when Lucas Pipes began issuing his “buy” recommendations in the Fall of 2021 would now be worth less than $1, when a 1-for-10 reverse stock split in May 2023 is taken into account.

While Pipes has repeatedly cut his price target for the stock, he has continued to report that it was worth buying. He is the only Wall Street analyst who still grades the common stock.

Greenidge is controlled by Connecticut-based Atlas Holdings through its ownership of a majority of a separate class of shares with voting privileges. It has operated the Bitcoin mining facility at the Dresden power plant since 2019.

Since then it has launched smaller Bitcoin mining operations in South Carolina, Mississippi and North Dakota.

On July 24, Greenidge CEO Jordan Kovler touted the company’s introduction of Pod X as a milestone “that not only further differentiates Greenidge from other bitcoin mining companies but also positions us competitively as one of only a few pod manufacturers in the world bringing an innovative mining infrastructure offering to the industry with this level of scale and efficiency.”

Atlas launched its Bitcoin mining operation five years after its 2014 acquisition of Greenidge, a former coal-burning plant that it converted to natural gas.

The company has long drawn fire from local environmental groups like Seneca Lake Guardian for the plant’s alleged harms to Seneca Lake.

“We applaud the DEC for laying down the law,” said Yvonne Taylor, co-founder of Seneca Lake Guardian. “Every day Greenidge keeps harming us. More harmful greenhouse gas emissions, the noise, the hot water…”

For more than five years, its water intake system lacked screens that are normally required under federal law. The plant also discharges unrecycled water warmed to 90 degrees or more into the Keuka Outlet, a state-designated trout stream.

Because the water flowing from the outlet into Seneca Lake warms the lake beyond state limits, the DEC has awarded Greenidge a waiver from those rules.

The company also acknowledges environmental liabilities of more than $30 million for a landfill and a coal ash dump that the U.S. Environmental Protection Agency is requiring it to clean up.

The DEC denied Greenidge’s application for a new air permit in June 2022 on the grounds that its continued operations conflict with the mandates of the state’s 2019 Climate Leadership and Community Protection Act, or CLCPA.

Greenidge promptly appealed that decision within the agency, and the DEC agreed to hear it. A DEC administrative law judge found that three issues merited further adjudication. But that appeal was concluded in May when the DEC’s Dereth Glance canceled a scheduled adjudicatory hearing and terminated the internal review.

Greenidge officials were furious. They slammed Glance’s ruling as “absurd … arbitrary, capricious and utterly preposterous.”

In a statement provided to a few favored news outlets, Greenidge vowed to seek an injunction through an Article 78 filing in state court.

Within the following three weeks, Greenidge President Dale Irwin had dumped roughly one-third of his common stock in three separate transactions.

The DEC promised to defend its rulings.

Earlier today, the DEC issued the following statement to WaterFront:

“On June 4, 2024 DEC notified Greenidge that it will be unlawful to operate after Sept. 9, 2024 and that Greenidge should prepare to close its facility in a manner that complies with all applicable requirements and is protective of the environment.”

The full DEC statement is here.

DEC never gets it right. I am surprised by the determionation. DEC has become a rubber stamp for any business regardless of environmental harm. NYS is a mess environmentally and the governor gives her concerns minor lip service.

Thanks for bringing this out into the sunshine, Pete! Sunshine is the best disinfectant!

LikeLike

Great news !!!!

LikeLike