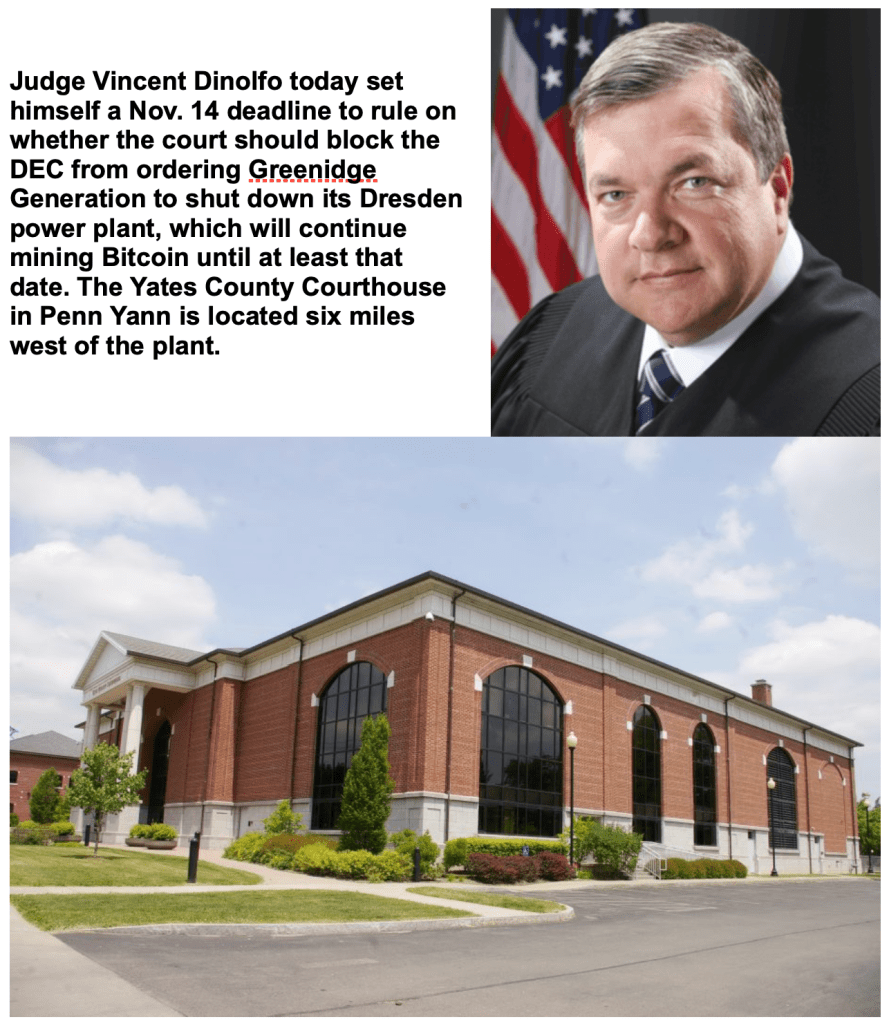

PENN YAN, Oct. 29, 2024 — At a hearing in Yates County Supreme Court this morning, Judge Vincent Dinolfo committed to ruling by Nov. 14 on Greenidge Generation LLC’s request to block a state order to permanently shut down its Dresden power plant.

Enforcement of the closure order, which had been set for Nov. 1, was postponed to Nov. 14 under an agreement between attorneys for Greenidge and the state Department of Environmental Conservation.

Greenidge sued the DEC in August for denying the company’s bid to renew its Title V air emissions permit. The suit asks the court to annul that denial and prevent the agency from requiring the plant to shut down.

In a brief filed Oct. 24, Greenidge asked the court to allow the plant to continue operating until 30 days after all appeals are settled in its lawsuit.

Greenhouse gas emissions from the plant have risen six-fold since the company began ramping up a Bitcoin mining facility at the plant in 2020. After the DEC refused to renew its air permit in 2022, Greenidge appealed within the agency and then filed suit in state court when the DEC terminated the internal appeal in May.

Greenidge has claimed that the agency based its denial on an improper application of a provision in the state’s 2019 climate law. Section 7(2) of the Climate Leadership and Community Protection Act says state agencies “shall consider whether (permitting) decisions are inconsistent with or will interfere with statewide (greenhouse gas) emissions reductions.”

At today’s hearing, Dinolfo did not tip his hand on which way he would rule.

But he zeroed in on the key provision when he asked Yvonne Hennessey, Greenidge’s lead attorney, whether Section 7(2) was “advisory or determinative,” and whether it was “functionally meaningless.”

Hennessey responded by saying the provision “doesn’t give them authority they claim,” but added that it was not meaningless or “toothless.”

She said the law obligated the DEC to fully explore potential mitigation options after it determined the plant was inconsistent with CLCPA mandates. It failed to do so, she argued, despite the fact that mitigation is a “cornerstone” goal of the climate law.

But Nicholas C. Buttino, an assistant state attorney general representing the DEC, said the agency did seek to learn Greenidge’s justification for its inconsistency with CLCPA and did seek its mitigation plans.

However, the company’s efforts to prove justification and mitigation were “half-baked” and “extremely bare bones,” he said.

Lisa K. Perfetto, an Earthjustice attorney representing three environmental groups who Dinolfo granted party status in the lawsuit, agreed.

“They failed to meet their burden of proof,” she said. That proof must be shown to be “real, permanent, quantifiable and enforceable,” Perfetto added.

The judge also asked if it was reasonable for him to issue a ruling “different from Danskammer.”

Dinolfo was referring to a 2022 case in which an Orange County Supreme Court judge upheld the DEC’s denial of a new air permit for Danskammer Energy LLC, a newly constructed gas-fired power plant. The agency had concluded that the plant would produce emissions inconsistent with the goals of CLCPA.

Attorneys for the DEC have argued in the Greenidge lawsuit that if Section 7(2) of the climate law does not give it authority to deny a permit, “the Legislature has mandated that the DEC engage in an ultimately pointless exercise; that is, the DEC must consider the goals of CLCPA in determining whether to grant a permit, but it may not deny the permit even if the proposed project does not meet the (emissions) goals and cannot otherwise be justified or mitigated.”

In December 2022, the DEC issued a policy memo, DAR21, that interprets agency responsibilities under Section 7(2).

Hennessey agreed that the case boils down to whether the provision grants the DEC broad power to deny permits without carefully weighing justification and mitigation. Greenidge is convinced it does not, and a contrary ruling would have broad statewide implications for future permit denials, she said.

Dinolfo agreed that the case could have a broad impact.

The issues raised in the case by two powerful Albany business groups in amicus curiae filings and affidavits, including the Dresden plant’s rule in supplying electricity for the state’s electric grid, were scarcely touched on at today’s hearing.

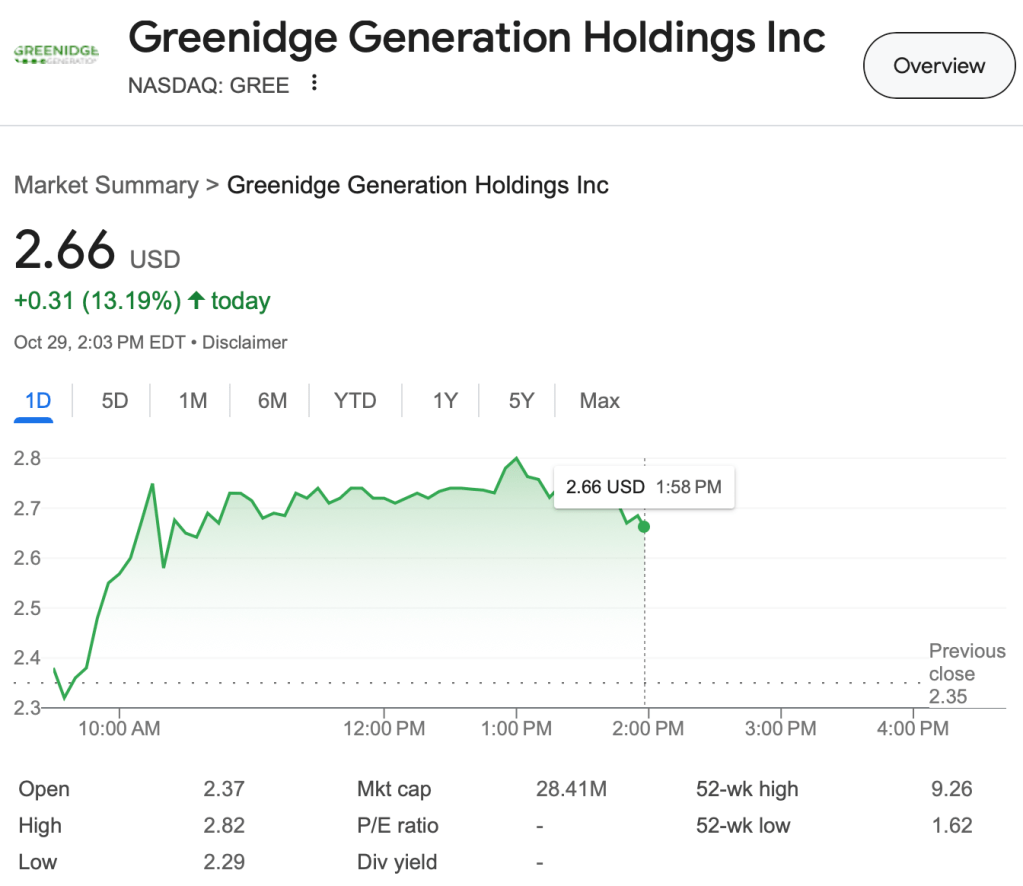

Although the judge did not signal how he was likely to rule, holders of Greenidge’s common stock — NASDAQ ticker symbol: GREE — began bidding up the price of shares even before Dinolfo declared the court in session.

By 1 p.m. shares were trading up 19 percent for the day before tapering off slightly a 2 p.m.

Last sentence…you did mean tapering and not tampering, I hope.

LikeLike